Allows registering clients agilely and securely through automatic validation against official sources. It verifies identity, legal existence, and key data, ensuring that each registration complies with the regulatory and risk requirements defined by the organization.

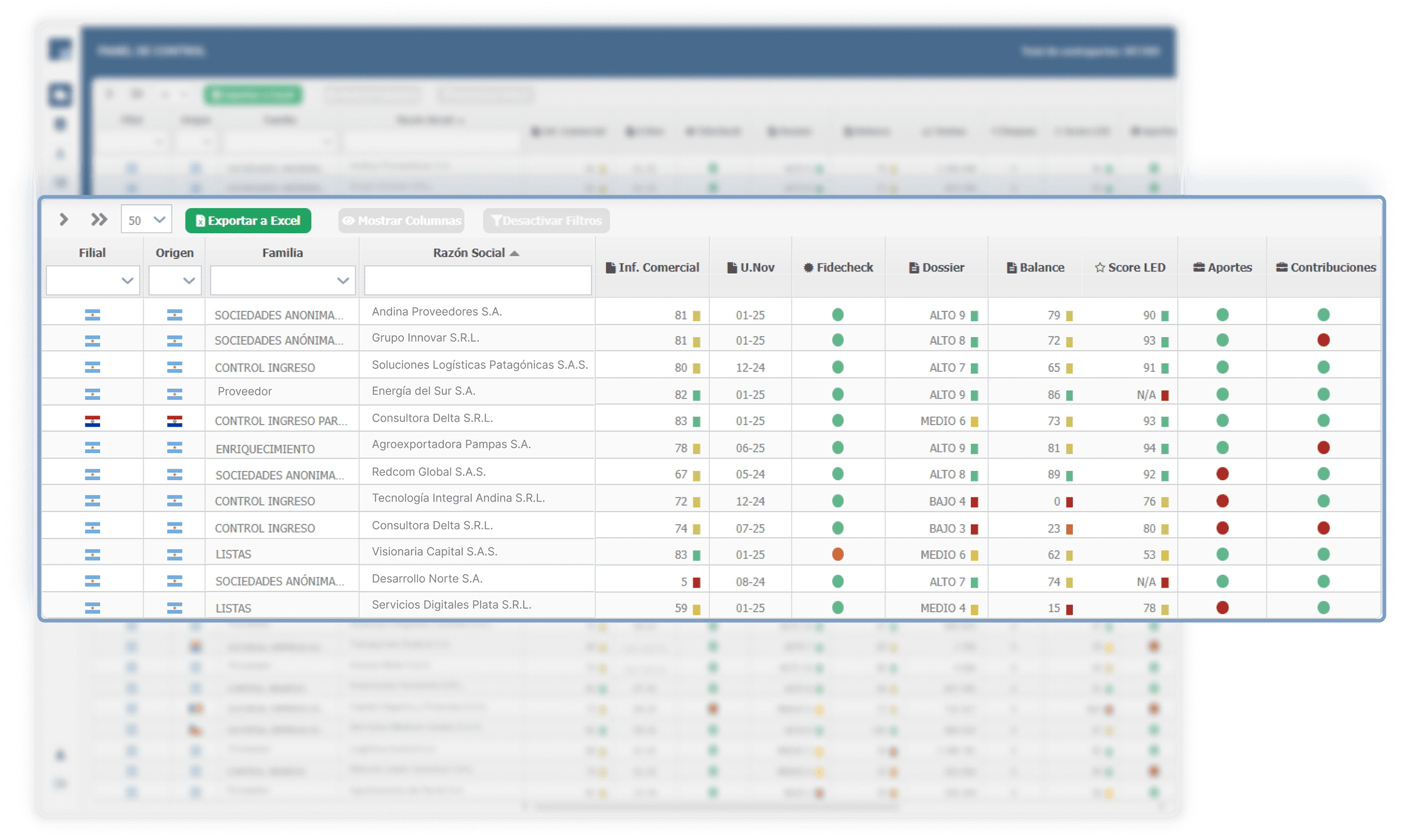

Centralizes all client information in a single place: credit history, tax status, corporate relationships, reputational alerts, and KYC documents. It facilitates a 360° view of the client, always updated and traceable.

Performs periodic checks on sanctions lists, PEP, and international sources. Sends automatic alerts regarding any relevant news and supports regulatory compliance through continuous and configurable controls.

Organizes the required documents for each client, controls expiration dates, and manages mandatory renewals. The entire document cycle is traced and available for internal or external audits.

Our automatic reports allow analyzing clients by industry, region, and credit capacity, facilitating more efficient commercial campaigns and decisions aligned with the real market potential.