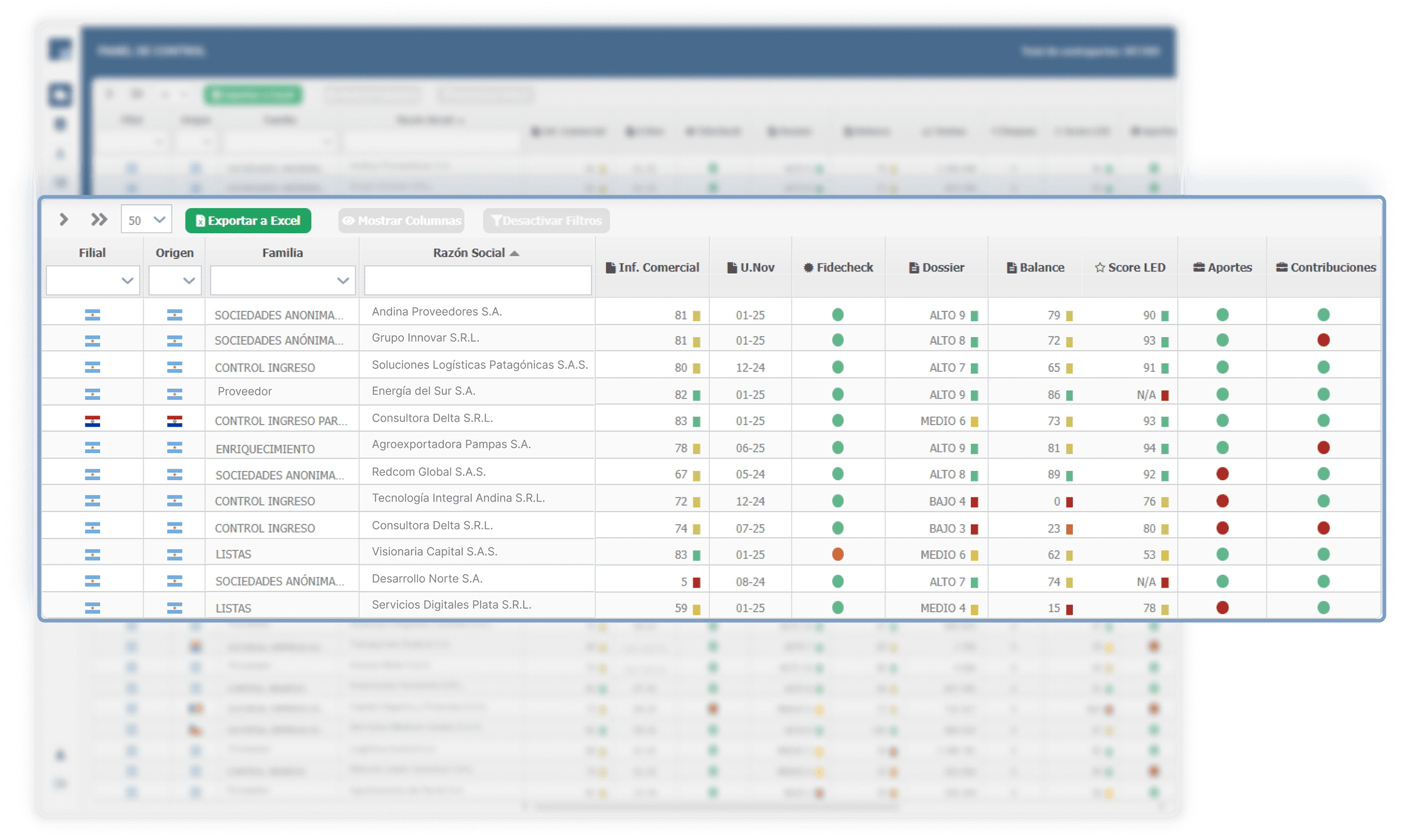

A dynamic dashboard displays key compliance indicators and allows access to reports from each business unit, subsidiary, or controlled company, improving agility in decision-making and strengthening organizational integrity.

The system identifies and manages risks in real-time, ensuring compliance with local and international regulations. It integrates AML/CFT/FP (Anti-Money Laundering, Financing of Terrorism, and Proliferation Financing) list controls and Politically Exposed Persons (PEP) checks, in accordance with KYC/KYB standards, considering the specific regulations of each country.

All related entities can host their corporate documentation, minutes, policies, and certifications within the Fidelitas cloud, with global access control for the parent company.

The system records and preserves every document version and allows requesting subsidiaries to periodically update their files, issuing automatic alerts when a file is about to expire.

The module considers different user levels:

– The controlling company, in charge of comprehensively supervising the status.

– Remediation users, who manage corrections or rectifications.

– Subsidiaries requested to upload documentation and receive feedback on their performance.

Every action is recorded in the platform, guaranteeing total traceability and accountability in each process.

Through relationship detection functions, the system identifies corporate links, economic groups, or matches between partners and internal employees, helping to prevent collusion or conflicts of interest.